You Deserve a Partner Who Sees the Full Picture

Expert financial planning and wealth management tailored for gold, crypto, and tech markets. Achieve long-term growth with personalized strategies that navigate volatility and maximize returns.

Features

Interactive tools like retirement quizzes and market trackers engage visitors while building trust. Educational blogs on gold trends, crypto regulations, and tech sector analysis position the firm as a thought leader. Secure CTAs for consultations and lead capture integrate seamlessly.

Gold Insights

Gold serves as a hedge against inflation and geopolitical uncertainty. We allocate 5-15% of portfolios to physical gold, ETFs, or digital platforms, rebalancing quarterly based on USD strength and central bank policies. This preserves capital during downturns while capturing upside in risk-off environments.

Crypto Strategies

Crypto portfolios focus on blue-chip assets like Bitcoin and Ethereum, with 10-20% exposure capped by risk tolerance. We employ staking for yield, dollar-cost averaging to mitigate volatility, and secure custody solutions integrated with estate planning. Tax-efficient harvesting and DeFi opportunities enhance long-term returns.

Tech Markets Approach

Tech investments target high-growth sectors like AI, semiconductors, and biotech via index funds, individual stocks, and venture exposure. We optimize for equity compensation in tech professionals, using sector rotation and active rebalancing to balance growth with valuation risks. Portfolios prioritize companies with strong moats and recurring revenue.

Wealth Planning Integration

Holistic planning ties these assets into tax-aware structures, retirement projections, and legacy goals using AI-driven tools for scenario modeling. Regular reviews ensure alignment with 2026 trends like private markets and hybrid advisory models, maximizing after-tax wealth transfer. Clients receive customized dashboards for transparency and adjustments.

Business Strategy

A deliberate framework for achieving competitive advantage and sustainable success. It outlines goals, resource allocation, and adaptive tactics across markets like gold, crypto, and tech.

- Diversify across gold, crypto, and tech with data-driven asset allocation to balance risk and reward.

- Leverage AI analytics for real-time market forecasting and personalized client roadmaps.

- Foster long-term partnerships via transparent fee structures and performance benchmarks.

- Adapt to 2026 trends like hybrid investments through agile portfolio rebalancing.

Business Security

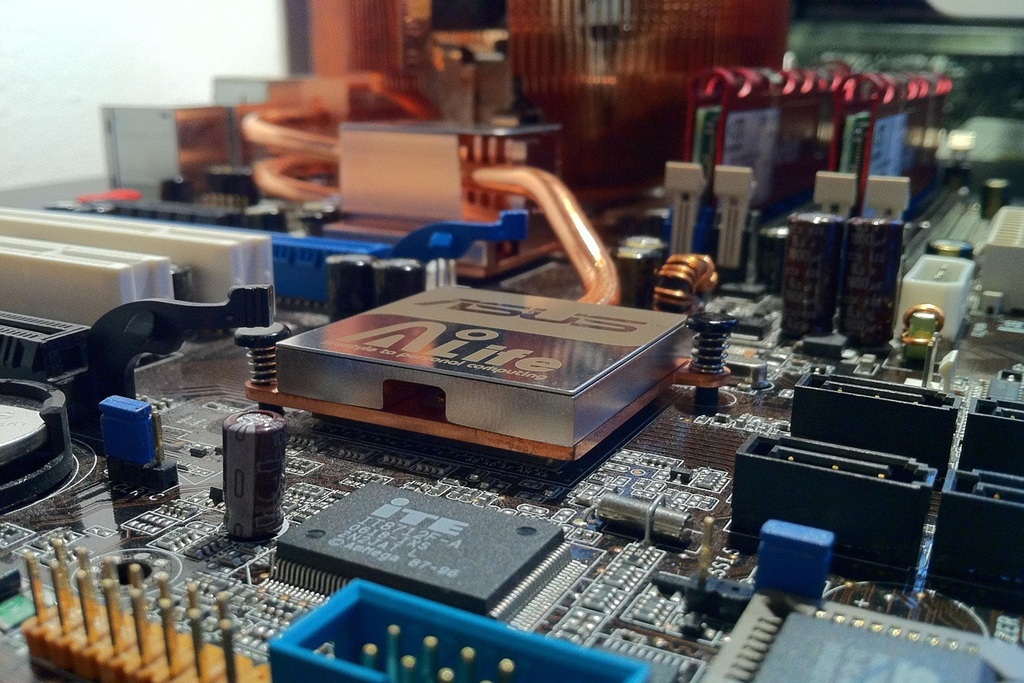

Robust protocols to protect assets, client information, and operations from risks. Essential in wealth management, it includes cybersecurity defenses and compliance to ensure trust and continuity.

- Enforce multi-factor authentication and end-to-end encryption for all client data access.

- Conduct quarterly penetration testing and employee cybersecurity training to preempt threats.

- Maintain compliant incident response plans with SEC-aligned vendor oversight.

- Offer asset protection guarantees, reimbursing verified cyber losses on managed accounts.

Services

Pebble Capital Limited offers comprehensive services in financial planning and wealth management, with specialized focus on gold, crypto, and tech markets. Our detailed offerings ensure personalized, resilient strategies for long-term success.

Strategic Wealth Management Services

From holistic financial planning to specialized gold, crypto, and tech market strategies, Pebble Capital Limited delivers tailored portfolios designed to protect, grow, and future-proof your wealth.

Explore Our WorkFinancial Planning

Tailored roadmaps to align your finances with life goals, including retirement, education funding, and major purchases.

Wealth Management

Secure exposure to precious metals as a hedge against inflation and uncertainty.

Crypto Strategies

Sophisticated management of digital assets with emphasis on security and yield.

Tech Markets Expertise

High-growth investment solutions optimized for innovation-driven sectors.

Business Security & Compliance

Enterprise-grade protections ensuring client trust and regulatory adherence.

Data Intelligence

Transforming raw data into actionable insights that inform strategic decisions and optimize business performance effectively.

AStrategic Wealth Solutions

Personalized planning to help you grow, protect and future‑proof your wealth through every market cycle.

Take Action Today

Begin building resilience and growth—your tailored plan awaits. Reach out via form, email, or call for immediate next steps.

- Schedule Free Consultation: Discuss your goals with our advisors in a no-obligation session.

- Get Portfolio Review: Receive a complimentary analysis of your current assets and diversification opportunities.

- Access Insights Now: Download our 2026 market outlook report tailored to resilient wealth strategies.

Pebble Capital Limited specializes in financial planning and wealth management, with expertise in gold, crypto and tech markets.

Pebble Capital Limited delivers expert financial planning and wealth management tailored to gold, crypto and tech sectors. Founded on principles of fiduciary duty and innovation, the firm empowers clients to navigate volatility with resilient, diversified portfolios.

Seasoned advisors bring hands-on experience in equities, precious metals, and digital assets, ensuring strategies that balance preservation with growth.

Founded with a vision to deliver superior service, financial security, and forward-thinking guidance, we blend deep market expertise with a fiduciary commitment to your best interests. Our advisors are not just qualified—they're seasoned strategists with hands-on experience in equities, gold, and cryptocurrency markets.